There are a number of possibilities you could talk about after you want to contrast organization financing solutions. Listed below are some to consider:

Devices funding: Devices money is a way to money sales out of products to have your company. Such finance is normally protected from the value of the company advantage you intend to get. This will possibly help to secure a low speed, even though this isn’t usually the situation. Very, if you wish to pick providers machines, They gadgets, gadgets, otherwise functions vehicles, an effective Prospa company mortgage would be a good replacement for gizmos finance.

Vehicles money, Business auto loan, Machinery loans: That is a convenient way of upgrading the fleet vehicles or to cover the cost of large assets instance harvesters, excavators, commercial cookers, etcetera. A great Prospa business financing might be able to coverage these things, correspond with all of us right now to get the full story.

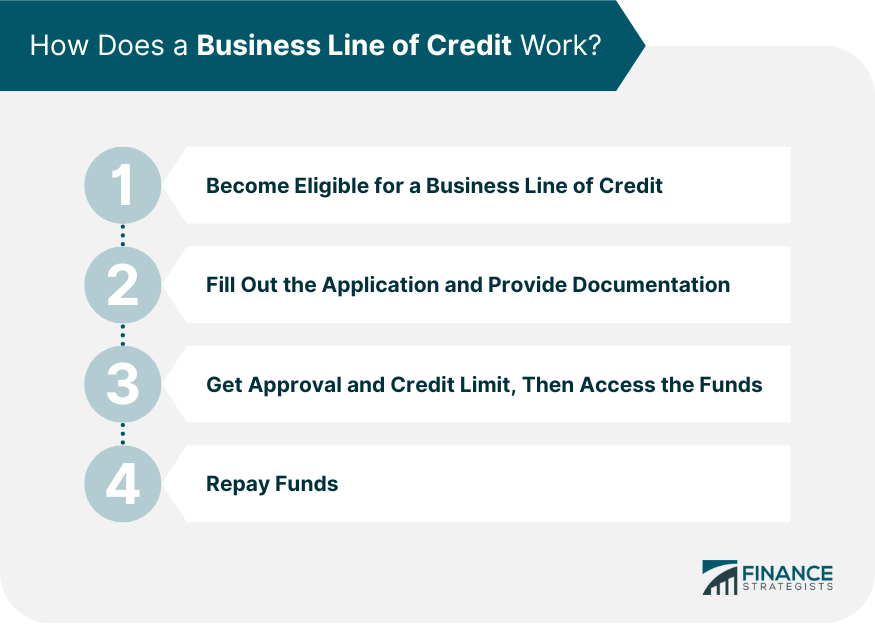

Organization overdraft: Also known as a business line of credit, that it convenient sort of loans can help small businesses safety quick-name cash flow holes. It is often used to defense costs such as payroll that will vary for many who implement seasonal casuals. Furthermore advantageous to shell out companies on time when you are waiting for your own personal statements to-be paid down by the consumers.

Some commercial funds require a deposit. Even though you don’t need to in initial deposit to try to get an excellent providers financing having Prospa, its a good idea to has actually a definite understanding of your entire earnings before you apply. It is Okay without having users and profiles of monetary study so you can resource. We know that small company operators is actually against it and you will tend to not be able to retain the records. To try to get to $150,000 , minimum trading records episodes use, an ABN along with your people permit

Conduct business funds believe in personal borrowing checks?

Such old-fashioned lenders, Prospa conducts borrowing from the bank monitors to adopt your own personal credit score alongside your company fitness. Credit reporting bodies often harvest a review of the credit history considering a range of products including exactly how many loan programs you’ve got already made, your borrowing from the bank for those who have one, one delinquent bills, past personal bankruptcy in the event the appropriate and you can any pending writs or courtroom judgments.

At Prospa, we don’t depend exclusively in your private credit rating, we focus on researching the condition of your company. I’ve install a complex credit check tool which will take into the membership more 450 independent items of advice. It’s novel so you can Prospa and you may lets us take some time to genuinely know the way your online business works and you will what loan amount will be the extremely relevant on businesses a lot of time-term balances.

For individuals who sign up for financing of $5,000 to $150,000 , minimum change history periods implement. If you’d like $150,000 to help you $500,000 we will want extra financials eg a P&L declaration. When you’re ready to see how far you might acquire and able to discover an easy method to invest in your own organization, contact a member of our amicable customer service team today for the 1300 882 867 or submit a quick and you may issues-online mode.

Do Prospa bring business loans inside the New Zealand?

Sure. Immediately following strengthening a powerful presence in the Australian SME . The difficulties to own advertisers inside the The new Zealand wanting to availability financing were just like those in Australia. Indeed, home business finance Granada loans from inside the The fresh new Zealand was basically before limited of large creditors, that didn’t frequently provide the services and products one to quick advertisers were looking for. Along with half a million small enterprises when you look at the The brand new Zealand, new chances to contain the development and money disperse with the field have been appealing to Prospa. That have software in less than 10 minutes and resource it is possible to in while the little because the 24 hours, the brand new discharge of a business concentrated lender like Prospa was asked which have unlock hands by smaller businesses and agents the exact same.