- Financing Label. This is basically the time more that your mortgage will get paid back, normally inside the increments out-of fifteen otherwise three decades. Its impacted by even if you really have a predetermined-speed title otherwise a varying-price title (ARM). Smaller financing words signify the borrowed funds will get paid back faster, whereas a lengthier loan identity provides all the way down monthly installments.

- Military Kind of. Whenever obtaining a beneficial Virtual assistant loan, armed forces services associates are required to give a certification out-of Eligibility (CEO) one shows your entitlement updates to your Va mortgage program. Eligibility for a Va mortgage is dependent on once you supported, the capacity where you offered, additionally the factor in your breakup otherwise discharge.

- Military Impairment. Being qualified having a military handicap into an effective Virtual assistant loan leads to specific extreme write-offs on the full loan amount. People that meet the requirements aren’t necessary to spend the money for Va money payment. At the same time, Virtual assistant lenders is count handicap money since energetic income into the an effective mortgage

- Earlier in the day Virtual assistant financing Utilization. It is definitely you’ll to acquire another Virtual assistant mortgage in the event the you’ve got currently used the entitlement program in the past. Virtual assistant home buyers should be aware the Va funding payment rates are 2.30% to possess first-day Virtual assistant mortgage consumers without down payment. The financial support percentage develops to three.60% for these borrowing from the bank a moment Va financing.

- Assets Income tax Price. So it count varies because of the venue, but typically drops doing step one.2%. Discover an even more specific quotation, ask your financial so you’re able to influence your property taxation matter.

- Home insurance. Injuries happens, and https://paydayloanalabama.com/chunchula/ that’s devastating in place psychologically and you can financially. Homeowner’s insurance brings safeguards for loan providers and you can property owners even though one to such as for example an accident occurs. It varies because of the county together with version of insurance coverage bought, with straight down limitations hovering doing step 1% and you will upper constraints hanging up to 6%.

Clearly there are numerous inputs that get factored under consideration when determining your own monthly payments into a Va loan. A beneficial Virtual assistant cost calculator is obviously a helpful device from inside the choosing a quote for those can cost you and just have provides you with a notion of what things to watch out for whenever plunging with the an effective financial plan of action.

There are also a few ways in which figuring value into the a good Va loan is different from calculating affordability on conventional loans. For one, as an element of significantly more positive and you can lenient conditions, active-responsibility and you can resigned army provider members, plus surviving partners, are not expected to spend individual home loan insurance policies (PMI). PMI is usually required by lenders having consumers who aren’t able to put down a down-payment off 20% or more into a house so you’re able to counterbalance the threat of the new family customer defaulting with the a loan.

Just how do The house Financing Specialist help?

Hero Financing, The home Mortgage Expert’s Virtual assistant Loan System. The experts, military provider users, in addition to their group are entitled to a trusting credit people who will fulfill them with a similar amount of interests and you may dedication it exhibited in their own services duties.

The reason being The united states Service from Experienced Situations claims one to area of the financing becomes paid down using federal-backed capital

All of our smooth underwriting techniques could possibly be done in the-family, expediting paperwork and you can removing a few of the stress regarding the just what can be or even feel just like an excellent bureaucratic procedure. The deal with-to-face means is actually a representation of our customized contact if this comes to providing our military service users and you can experts do an effective financial plan of action that can get them towards the home of the hopes and dreams.

A cost calculator is a superb solution to initiate the newest homebuying techniques, however, a specialist bank can offer you a great deal more exact information about how much house you really can afford. Give us a call in the 800-991-6494 to speak with our amicable financing gurus otherwise get in touch with us by way of our very own app to get started towards the the road so you can homeownership now.

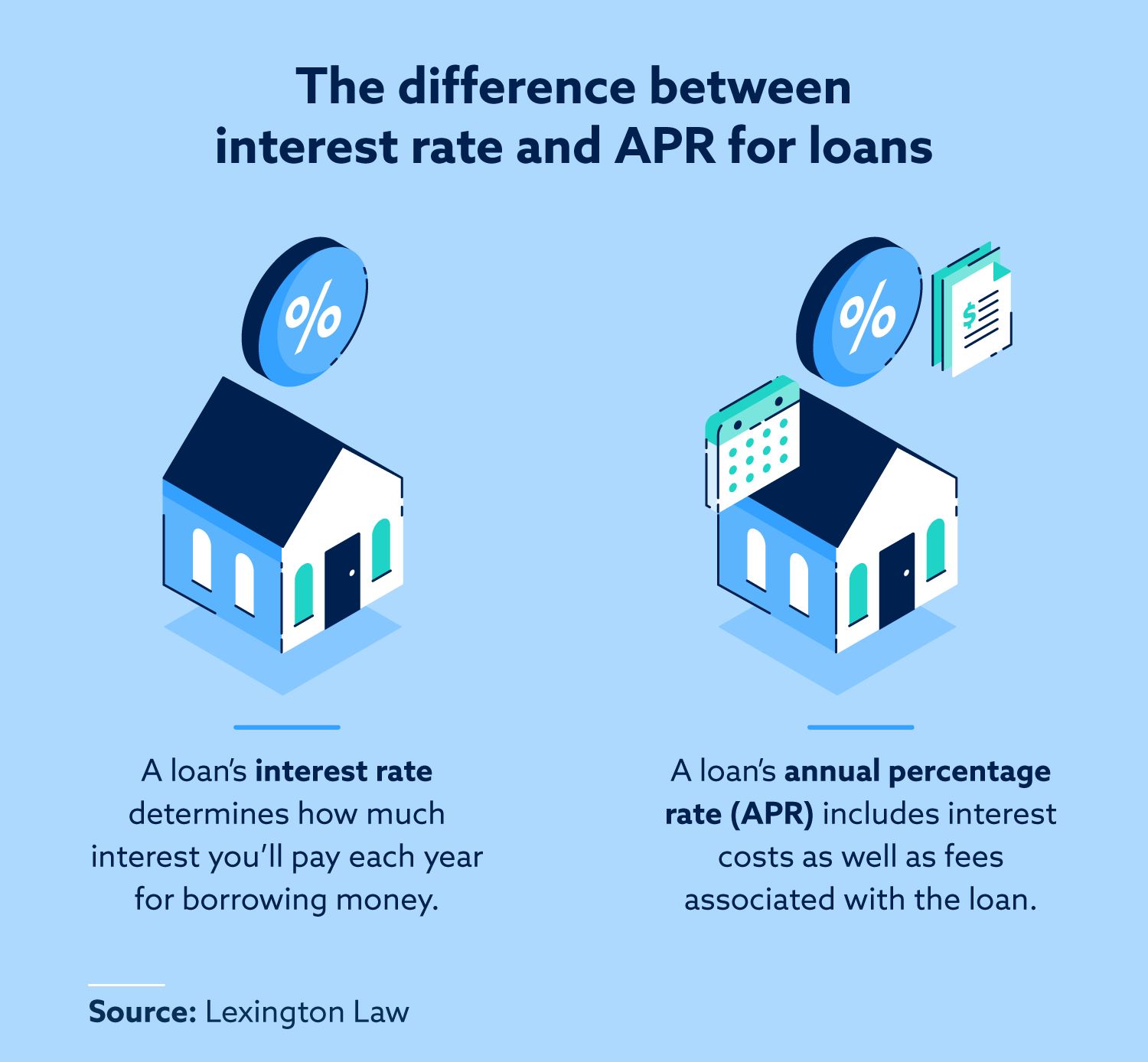

- Rate of interest. With regards to the loan term, credit rating, and some other private economic items, interest levels into an effective Va mortgage already slip within this a range of just one.875 to help you 2.75%.