On the pursuing the areas, we details the types of government-recognized and you may traditional mortgage loans that you may possibly be eligible for once the Section 13 case of bankruptcy processing.

Conventional Loans After Section thirteen

When compared with FHA loans and USDA funds, traditional and you will conforming loans tend to be much harder so you can qualify for immediately following declaring bankruptcy. If you find yourself hoping to get that loan out of Federal national mortgage association or Freddie Mac computer, you won’t be able to get it done unless you discovered a beneficial discharge otherwise a great dismissal. Having a good dismissal, you will need to wait four years.

https://elitecashadvance.com/personal-loans-al/

Such as the big date it needs to complete their fees bundle, it may take five to eight ages one which just be considered getting a traditional loan immediately following a case of bankruptcy launch. In the event the circumstances is actually disregarded, you’ll hold off several years adopting the dismissal time. Simultaneously, those with several personal bankruptcy filings on their credit history can get an excellent eight-seasons wishing months prior to capable apply.

Should your bankruptcy case otherwise dismissal are because of extenuating activities, for example a career losings or a significant disease, maybe you have a less strenuous big date qualifying for a financial loan. Lenders will appear at your state to decide whether or not the extenuating points was basically out of your manage, perhaps the items was basically resolved, and you can whether or not those people troubles are browsing get back.

FHA Loan Once Chapter 13

FHA funds was bodies-supported and you may covered because of the Federal Property Management (FHA). Should you want to rating a keen FHA mortgage loan, you’ll want to hold back until youre about twelve months to your Chapter thirteen bankruptcy proceeding fees bundle instead of destroyed one payments. You should along with discovered consent about case of bankruptcy courtroom when planning on taking away yet another loan if you find yourself their case is constant.

Once you’ve successfully received their Part thirteen personal bankruptcy release, there isn’t any prepared months to have FHA fund. The job could be yourself examined by the home financing underwriter unless two years provides enacted since your discharge day. Most people prefer it loan sort of, due to the fact FHA mortgage statutes be more easy as compared to laws and regulations out of almost every other financing designs.

- Lowest credit history away from 580 that have a great step three.5% deposit (or a reduced credit score which have increased downpayment)

- Youre purchasing the family since your top residence.

- The debt-to-money ratio doesn’t go beyond 50%.

- You have steady money and a job.

- You may be seeking financing you to definitely drops contained in this FHA loan limitations.

Va Money Shortly after Part thirteen

Va (Company regarding Veterans Points) money are also backed by government entities. After you have finished their Section thirteen processing and you may received your own discharge regarding courtroom, you won’t need to fulfill another special criteria. Virtual assistant finance do not require a downpayment, and they will often have a low interest rate.

- You are at the very least 1 year to your Chapter thirteen payment bundle, along with produced into the-time monthly premiums on bankruptcy proceeding trustee.

- Your own fico scores are in the new fair to a good assortment. While there is no lowest credit history, very lenders like to see a credit rating between 580 and you can 620. Thus, when you yourself have a great 750 credit rating, including, you’re going to be in addition to this of.

- You must have qualifying military service given that a recently available service representative, a qualified veteran, otherwise a thriving companion.

USDA Money Once Part thirteen

USDA money are usually inexpensive than other finance, however they are and harder in order to be eligible for. They are also supported by the us government.

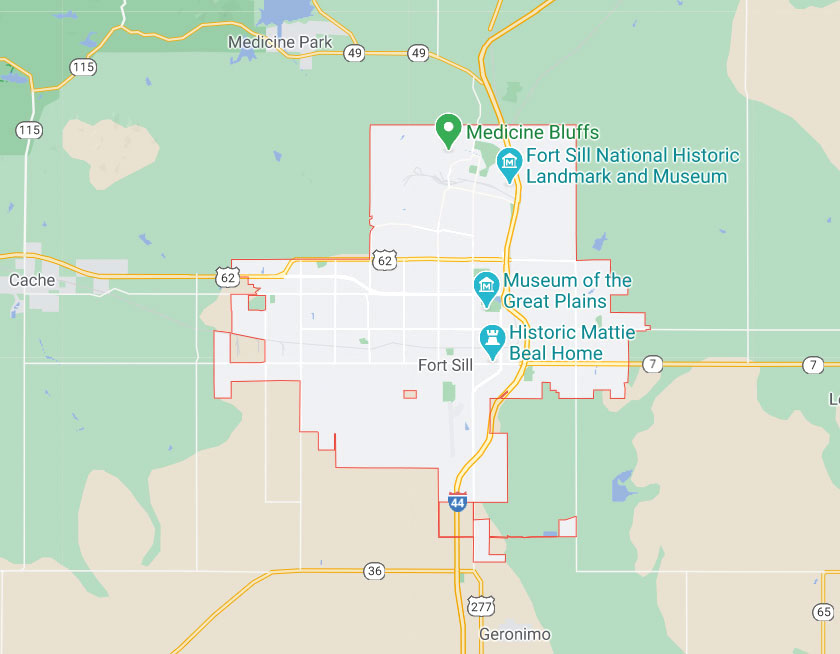

- You have an excellent credit history. Extremely USDA lenders look having a rating of at least 640 or more.