Q: I am doing some house renovations this season, and you can I am not sure simple tips to fund everything. Would I sign up for financing? Do i need to only charges all expenses to my bank card? There are a lot solutions! Which helps to make the extremely experience having my personal profit?

A: Regardless if you are gutting any home or simply springing getting good new coating of paint and new accessories, Azura keeps your secure. During the Azura Borrowing from the bank Relationship, you’ve got several options with respect to money a house repair. You could potentially unlock a great HELOC, otherwise a property Collateral Personal line of credit, that is an unbarred line of credit that’s secure by the residence’s value for up to 10 years. You can also funds their renovations with your own otherwise unsecured mortgage, use your credit cards otherwise have fun with a retail mastercard that’s connected to a home-improvement store, like Lowe’s or Domestic Depot.

One of the best a way to fund a home repair try by taking out a home Guarantee Loan. Why don’t we look closer at this preferred mortgage and its own advantages.

What is a house security mortgage?

A home security mortgage try a loan secure by a residence’s really worth. It indicates the house functions as equity with the mortgage and you can guarantees the amount of money lent.

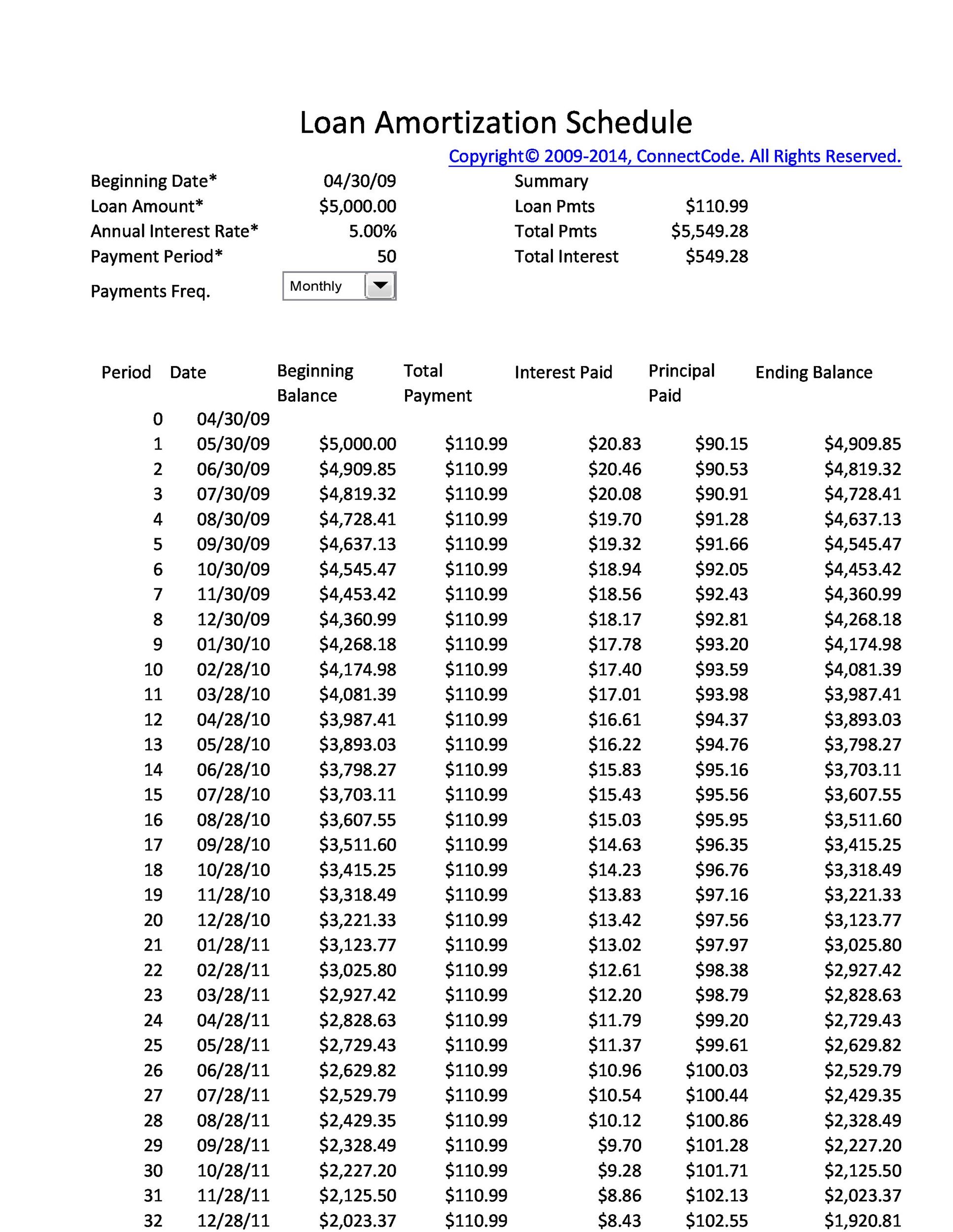

Whenever individuals discover a home collateral mortgage, they are going to receive a predetermined amount of money in a single lump sum. The total amount might be eligible for try computed with regards to the residence’s financing-to-well worth (LTV) proportion, percentage title, earnings and you can credit score. Very family security funds, also people offered by Azura, features a predetermined interest rate, a fixed identity and a predetermined payment per month.

What are the great things about property security financing?

An important benefit property security loan enjoys more almost every other finance, such as the HELOC, is their repaired interest rate. This means the brand new borrower knows just how much brand new payment per month is for the whole life of the borrowed funds, and come up with cost management with the costs much easier. This can be specifically useful in a whole lot of rising rates of interest because borrower’s loan is not susceptible to the broadening costs from changeable finance. Together with, the eye reduced on a property equity mortgage is sometimes 100% tax-deductible (speak to your tax agent getting information).

A special advantage of a home security financing was its consistent installment package on lifetime of the mortgage. In lieu of a good HELOC, which in turn just needs repayments on the the newest loan’s desire during the basic 5 years, individuals could be making repayments towards the the latest loan’s interest and you will prominent regarding longevity of the mortgage. Particular financing, like those at Azura, even ensure it is borrowers to invest straight back huge sums whenever they prefer, even if of many commonly fees a penalty to possess early money. Regardless of the lender’s policy, after the borrowed funds title, the entire count owed might possibly be paid up.

What are the downsides away from property security loan?

When you find yourself a house security financing now offers borrowers access to the money wanted to shelter do-it-yourself ideas which have an inexpensive cost package, it is essential to find out about every aspect of the loan before implementing.

Here’s what you need to know:

Taking out a home equity mortgage mode using numerous fees having the fresh new advantage out of borrowing currency resistant to the domestic. It’s best to find out about these charges and how much might total overall before applying for a financial loan.

And additionally, whenever opening property guarantee loan, individuals will have all financing in one take to. This is going to make a house equity mortgage a beneficial selection for home owners exactly who know exactly what type of works they will carry out into their homes as well as the projected total costs for that actually work.

For people who simply have a vague tip throughout the and this renovations you can easily perform as well as how far they rates, your ount of money. Instead of can you balance transfer loan? a great HELOC, once the financing is removed, there isn’t any way to add to the amount.

Ultimately, borrowers will need to build a payment per month to your mortgage, no matter what the financial updates at the time. Whenever they standard into the loan, they may reduce their property. Because of that, before you take away a home collateral loan, individuals should make sure they could spend the money for monthly payments towards the loan.