Posts

We ensured to include all the expected information about for every provide and you will gambling establishment site who may have such a brighten. Very, don’t hesitate – hit the reviews and see exceptional venues to enjoy these types of benefits in the. You will want to take into account the quantity of rounds and their expiration go out before you make the group of a lot more games.

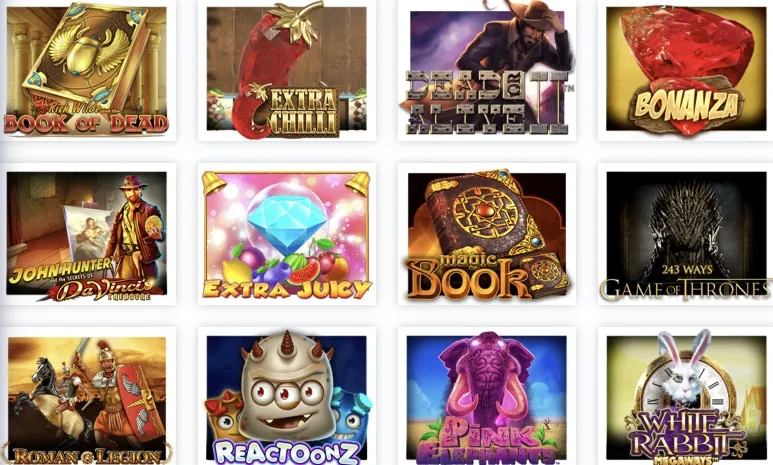

As the joining in may 2023, my personal main goal could have been to https://sizzlinghot-slot.com/sizzling-hot-slot-paypal/ incorporate our customers that have valuable expertise to your field of online gambling. Particularly if the driver are offering countless revolves, they’ve been passed out within the shorter installments. In this case, ensure that you come back to the new gambling establishment daily so you wear’t overlook their spins. Given that i’ve secure a knowledgeable offers to own inside South Africa, let’s dive for the certain effective ways to benefit from him or her. To maximize the feel, absorb the following advice. Room Gains Gambling enterprise has created a varied slot portfolio featuring headings away from best industry builders, such as Microgaming, Playtech, and NetEnt.

Or, you can be the first ever to is the newest casino games, where you rating an amount of free revolves to play to your another position release. An informed internet casino with no put spins are certain to get fair wagering criteria and terminology connected to the give. When awarding free spins, web based casinos usually typically provide a preliminary set of eligible online game out of certain builders. Risk.us is the 100 percent free-to-play type of Share.com, a great crypto local casino recognized for the celebrity-studded partnerships with Drake, the new UFC, F1, and much more.

100 percent free spins is subject to comparable conditions, but your WR should be according to the payouts you have made on the 1st spins. You can find possibly fifty free revolves to utilize to the specific ports online game. When you perform a merchant account and make in initial deposit (if a deposit is necessary), the new totally free revolves was immediately put into your bank account to possess explore on the selected game. Some casinos may need a bonus code during the membership, however, i list these types of obviously as well. Should your give falls under a welcome render, it might be booked for new consumers merely.

What are the greatest advantages of playing from the totally free revolves gambling enterprises?

Always comment the new gambling establishment’s fine print to possess specific details. However, after burnt, people available earnings is appropriate for a further thirty days very you’ll have time to satisfy the newest wagering criteria connected. The new slot game will work just like normal with the newest different from limitation earn restrictions. Once you’ve done any wagering conditions, you could withdraw payouts since the real cash.

Play high RTP slots

I like casinos certainly demonstrating the conditions and terms, particular even reflecting a good 1x playthrough needs. The new people discovered a pleasant incentive which have totally free Coins and Sweepstakes Coins, and an economy on the additional Sweepstakes Coins. When you sign up, you’ll receive Gold and Sweeps Coins to begin with to experience immediately. Jackpota.com is not difficult to use, to help you quickly join and begin to play your chosen game.

Tips claim Yebo Gambling enterprise 150 totally free spins

We understand that every You.S. casino players enjoy playing games on the run, therefore we be sure for each on-line casino works mobile-enhanced websites otherwise local casino applications the real deal currency. We remark this type of systems to be sure online game incorporate HTML5 technology to own a finest user experience. For example, after you put at the least $twenty-five in the an internet casino, you could found $twenty-five inside the added bonus money along with 50 free spins to utilize on the a specific position online game.

Internet casino No-deposit Bonus – Finest Bonuses As opposed to Deposit

- To find the spins, what you need to do is actually click the claim switch below and you will go into the extra password “HOTLUCKY50” by the ticking the new promo code field because you create a free account.

- So even if you perform hit you to definitely seven-profile progressive jackpot position, their effective is capped.

- This is probably one of the most nice 100 percent free twist now offers we have present in The usa.

- Away from security in order to extra high quality, we log off no brick unturned – giving you comfort you could potentially completely faith our very own information.

Free spins no deposit try a greatest form of incentive in which people discovered a specific amount of spins to your a specific slot video game without the need to make 1st deposit. Merely joining a new gambling establishment account is sufficient to allege such totally free spins. That it provide lets players to explore the brand new local casino’s online game and you may probably victory a real income instead risking their cash. 100 percent free spins is a well-known internet casino added bonus that provides professionals 100 percent free revolves to the slot machine game, either without using their currency. Profits produced from all of these complimentary revolves are usually subject to wagering requirements before any withdrawal is possible. A no-deposit totally free spins incentive is an excellent solution to have fun with the latest real cash position game rather than risking your own money.

- E-purses supply the fastest earnings and that can differ of instantaneous around 24 hours.

- To help you allege the new spins, just go into the added bonus password “ENTERTAIN@US” when creating a free account and you will be sure their e-send address by the clicking the link provided for they.

- One of the biggest great things about no deposit free revolves is actually the fact that they rates absolutely nothing to allege yet truth be told there’s still a chance of making genuine victories.

- RTP (Return-to-player) is actually determined over several years, and some players use it to optimize their go back opportunity by earning straight back of a position.

- The fresh fine print will contain a list of game which you acquired’t manage to make use of bonus victories for the.

- Totally free spin zero bet product sales are among the greatest extra offers it is possible to claim.

Real cash totally free spins you would like a bona fide money put to allege, and you can earn real cash with your totally free revolves. Typically the most popular ‘s the no deposit 100 percent free revolves, however, there are many more the way to get totally free revolves. PlayCasino is designed to provide all of our members having clear and you will reliable information for the finest web based casinos and you may sportsbooks for South African people.

Well, thankfully one the very best gambling enterprise web sites in the uk no deposit perform render these incentives particularly because of their dedicated people. One of several good reason why casinos offer no deposit bonuses to help you existing professionals should be to award its loyalty. It’s certainly it is possible to to help you earn a real income away from a no-deposit bonus, exactly as it’s you are able to to help you earn real money away from any kind of gambling enterprise added bonus. Although not, after the day, web based casinos are a business, and so they needless to say should limit the amount of money you to definitely it get rid of because of these promotions where it is possible to.

Over the 2nd partners parts i’ll teach you simple tips to evaluate Australian continent-focused no-deposit 100 percent free spins such a professional. Cellular totally free revolves appear to your any device of your choice, in order long as you opt for a completely optimized gambling enterprise webpages. We have collected a listing of useful tips techniques and strategies to help you discover best 100 percent free spin offers to maximise your chances of success.

To provide a flavor of what’s readily available, our very own pros have highlighted probably the most common totally free twist incentives and you can intricate ideas on how to allege them lower than. Periodically, the newest offers lower than may well not satisfy the casinos i highlight. This happens if the provide is not on the market on your own part.