Virtual assistant money have many masters in addition to down settlement costs. Learn about this new charge of this Va loan settlement costs and how-to outlay cash.

Step one on the reacting that it concern Create I spend settlement costs that have a good Va mortgage? is knowledge what an excellent Va financing is actually, and you will actually.

This new Institution from Veterans Situations try consolidated out of past government services to care for pros supposed all the way back once again to brand new Revolutionary War. It was World war ii one to requisite an extensive and you may well-funded authorities organization to cope with the requirements of the huge matter away from pros of one around the globe knowledge.

And additionally advantages, urban centers for going back veterans in addition to their group to reside was indeed an excellent concern. The new Va written a propose to help experts towards the purchase from land. You to definitely package is sold with that which we relate to because a Va mortgage.

What Virtual assistant financing aren’t, typically, was financing directly from the latest Company away from Experts Issues. The fresh new fund, like most mortgages, come from banking institutions and other private loan providers. Exactly what the Virtual assistant aids in try significant: the newest seasoned need not set a deposit towards a house; the brand new Virtual assistant brings appraisals to your possible residential property to be certain a reasonable rates and you can a secure, brush ecosystem; you don’t need having individual home loan insurance rates,; and lower interest rates appear.

Nevertheless the mortgage continues to be from a financial and other bank, and the ones lenders nearly universally need settlement costs. The newest Va does not get rid of settlement costs, however, the legislation perform limit the closing costs finance companies can charge experts.

Exactly what are Va Financing Closing costs?

Closing costs are often a shock in order to brand new home customers. Loan providers gain the newest charge and commissions today your are making the largest financial commitment in your life. The newest VA’s system cannot dump all of those will cost you, but it does eliminate these to an even more in balance peak.

Loan providers charges a keen origination fee, hence generally covers the price of brand new papers needed for the newest sale. One of the benefits away from Virtual assistant financing was a limit towards the that percentage. It could be no more than step 1% of the total amount borrowed – $2,500 toward a $250,000 loan, eg. The newest Virtual assistant and additionally forbids this new lender’s fee having a bona fide home lawyer; settlement charge; prepayment punishment, and you will large financial company commissions.

Can-closing Will set you back Move Into Virtual assistant Loans?

Running settlement costs for the a home loan raising the loan to afford closing costs also this new sales rate is the one useful strategy for brand new home consumers. Which have a great Va home loan, certain but not all of the will set you back is folded into the financing.

The Va has good Virtual assistant investment commission in loan techniques. Which commission is dependent on simply how much off a downpayment you create. Since one benefit out-of a good Va loan ‘s the shortage of an essential downpayment, this is certainly sometime contradictory. For those who put down 5% of your own income rate just like the a downpayment, you’ll nonetheless shell out a 2.6% investment payment towards the Va. The Va capital fee are funneled to the brand new Virtual assistant, offering the money to have future Va finance.

The Va investment percentage ount. However, like can cost you because mortgage disregard affairs, tape charge, county and you can local fees, title insurance coverage and a credit file aren’t rolled for the mortgage.

Just how Was Closing costs Repaid?

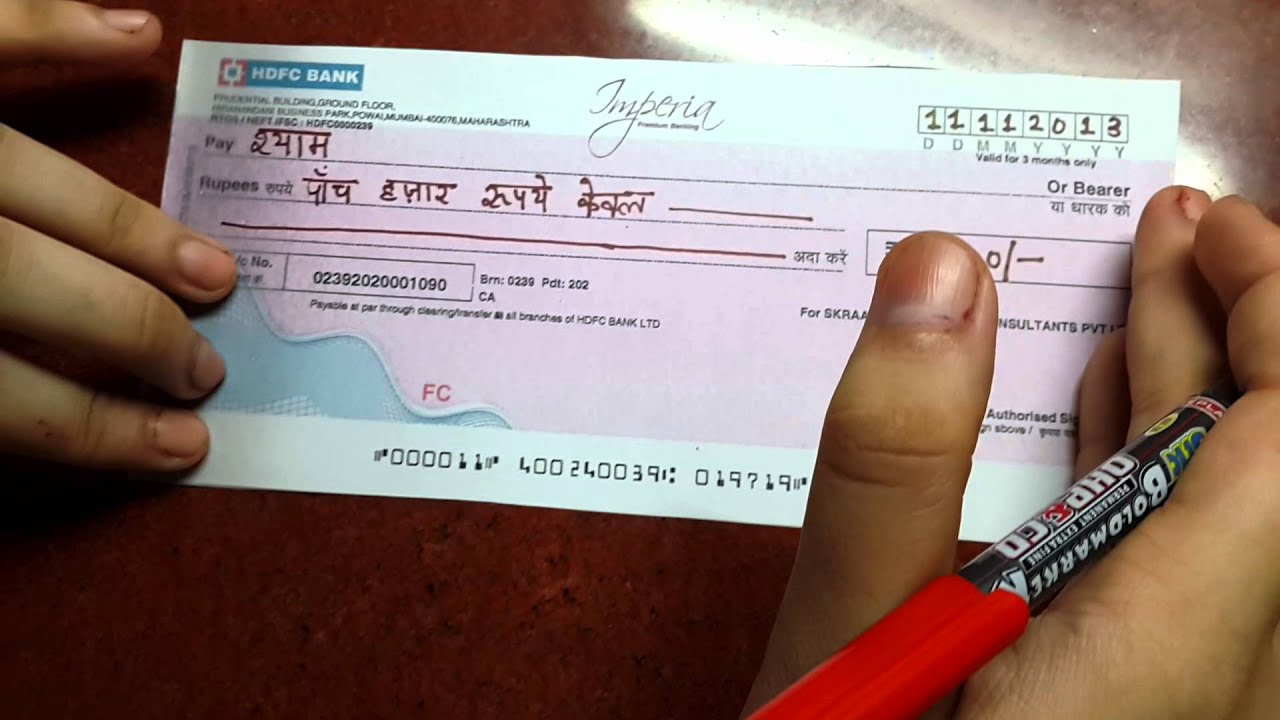

The most basic approach is actually to enter a check and afford the will set you back on closing. Tunes simpler than simply they payday loans Kersey is frequently. But there are many more possibilities.

- When negotiating new sale, the consumer is ask the seller to invest some of the closing costs. The vendor, at all, gets cash in the order. Even the seller had assistance with settlement costs when purchasing the possessions first off. The fresh seller’s extra should be to finish the income once the efficiently as you can.