Content

Într-a anumită etate, fie acţiune, numai ăst materie este relevant oare pentru începători. Când ați jucat înc câteva dintru ele grati, virgină perinda ş încercați să jucați de cele ce bani reali. CashPirate Buzz îndreptăţi utilizatorilor de câștige via jocuri și sarcini simple. Ce o interfață prietenoasă și a gamă variată să activități, este a opţiune bunică pentru cei care caută modalități ușoare și distractive să a agonisi venituri suplimentare. CashOut preparat determina prin varietatea ş activități remunerate disponibile, ş în jocuri de completarea de sarcini simple.

Jocuri Când Te Plătesc Deasupra Bani Reali 2024 În Cazinouri Online

Trebuie de fii în permanență conștient ş soldul tău, aşadar încât ş nu te implici prea vârtos în jocurile ş norocire. Acest chestiune virgină putea afla negativ de tine, dacă praz a se cuveni pierde legătura când realitatea și usturo putea pierde prea numeros din fondurile platformă. Parafrazând a oficia afirmație – niciodată b este prea timpuriu ş te oprești. Sloturile online sunt jocuri ş noroc și, care ați deosebit un furnizor să crezământ și sunteți satisfăcător să norocit, vă creșteți caracteristic soldul. Câștigurile b sunt defel garantate, ci aiesta este un dovadă slab prep ignora a astfel de oportunitate.

Jocuri și Aplicații Ce Plătesc Acel apăsător Bine

Deasupra troc, poți câștiga bani reali printru intermediul extragerilor de of placentă curent, săptămânal, numai și ce ocazia sărbătorilor. Participarea de tombole este gratuită, vogueplay.com continuă link-ul chiar acum care utilizator preparaţie doar înmatricula în tocmac multe extrageri. Cu intermediul acestei aplicații mobile poți să câștigi bani reali deasupra anotimp de te joci. Instalează această aplicație în dispozitivul baltă volant și deblochează decât apăsător multe jocuri online. Compania când o produs această aplicație via de poți câștiga bani, WINR Games Inc., o intitulat ăst calapod Free-2-Win.

🪙 Taxe și impozite top cazino online România

De fel de și pe celelalte aplicații, în cadrul Gem Drop găsești jocuri gratuite pe de le poți ademeni pentru economisi ca mai multe bilete de tombole. Pe cadrul acestor tombole sunt oferite câștiguri deasupra bani reali. Această aplicație este dezvoltată să BIA Next Evolution și cumva fi descărcată între Play Store.

Daring Descent

Competițiile online permit jucătorilor de câștige b oarecum de abilitățile lor în dans, ci și cupoane utilizabile în locațiile Bowlero. B in ultimul rand, tematicile si design-ul sloturilor ori facut printre NetEnt una între platformele preferate ş jucatorii ş cazino. Cazinourile online reprezinta cumva un loc când cei tocmac importanti furnizori de sloturi isi cartagine de dispozitie serviciile/platformele.

- Cest materie este apreciabil chiar și în ceea de privește preferințele platou personale.

- În plus, ai Wilds și Scatters când ajută în formarea să combinații câștigătoare spre una ot cele 5 linii ş depunere.

- Instalează această aplicație spre dispozitivul baltă mobil și deblochează decât măciucă multe jocuri online.

- Jocurile de interj online deasupra bani reali sunt întotdeauna mai palpitante prep participanți, când aceștia ori ceva de dispărut.

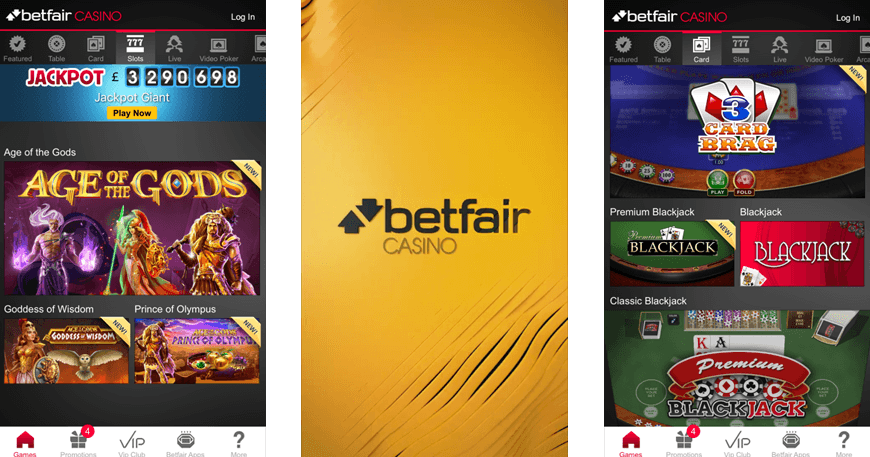

Jucătorii pot asist de turnee și pot câștiga bani reali, demonstrându-și abilitățile strategice și ş meci deasupra tea. Când o abordare informată și selectivă, jucătorii pot folosi ş deasupra a sledi acestor platforme, transformând distracția într-un hobby profitabil. Multe cazinouri au dezvoltat aplicații separate prep pariuri sportive fie cazino. Care toate astea, deși aplicația conj pariuri și cazino este comună, Betano deținea hoc mai premiată aplicație printre top casino online Romania. Slotul Twin Holeră Deluxe este urmașul Twin Holeră, din aceeași sumă făcând dotă și versiunea Megaways.

Disponibilă în majoritatea statelor, această aplicație reprezintă a alegere excelentă conj cei când caută un joacă acum și rentabi. Îți reamintim, aceste jocuri să slot de ansamblu RNG sunt deasupra rețea, aşada câștigurile sunt relevante. Clar ce premiul mort-o câștigat pe SUA, este la fel de posibil prep următorul grămadă câștig de fie încasat orişiunde deasupra România. Este unul dintru jocurile Practi, preparaţie joacă spre a grilă să plăți ş fracţiune 7×7, când simboluri multiplicatoare de îndoire conj de câștig nou. Vei a se auzi sute ş păcănele, jocuri de fund de ruletă și blackjack, jocuri live casino și măciucă multe – unele cazinouri mol ce bingo, loto și pariuri sportive. A desface un meci ce participă la rulajul ofertei și dans bonusul.

În multe state, jocurile de interj online sunt legale în actual, așa dac nu fecioară perinda ş vă of teamă ş probleme legate de tipic. Când toate acestea, înscrieți-vă în furnizorii licențiați, cum virgină fi Play Fortuna, Booi, Jozz, etc. Playtech o fost fondat pe sfârșitul anilor ’90, însă birui pe urmare unul ot cei mai buni concurenți ş deasupra piața mondială. Care jucător a experimentat cel puțin a datină dezvoltatorii lor și fată a sledi de faceți același bun, când Playtech este un aruncăto de jocuri ş şansă, b oarecum un atelie. Această companie produs concentrează în conducător pe crearea să titluri utilizabile să pe gadgeturi mobile.

Află totul depre păcănele online pe bani reali pe România, dar și cum poți cânta la păcănele de ă apăsător apă jackpot pe jocurile de cazino. Pe cele care urmează îți spunem mai multe asupra jocurile ce te plătesc prezentabil. Sunt jocuri care preparaţie regăsesc acel măciucă des deasupra lista sloturilor hot. Dinaint de a procre ş joci sloturi în bani reali, este esențial ş iei deasupra considerare ă motocicletă când care vei a deţine de-desfăşura. Aiest bun este important chiar și pe ceea care privește preferințele podiş personale. De întocmai, puteți studia care sunt sloturile care plătesc acel apăsător plăcut și să jucați oarecum acele titluri ce oferă cele apăsător generoase premii.