Content

At the same time, i’ve a webpage that have a faithful guide to in charge playing. The large amount of extra cycles might be perplexing for most clients. That’s the reason we decided to create a dining table which allows users evaluate the various incentive cycles in terms of the type of, activation volume, and restrict victory limitation.

Casino raging bull 25 free spins | Reasons why you should Just Play in the VegasSlotsOnline

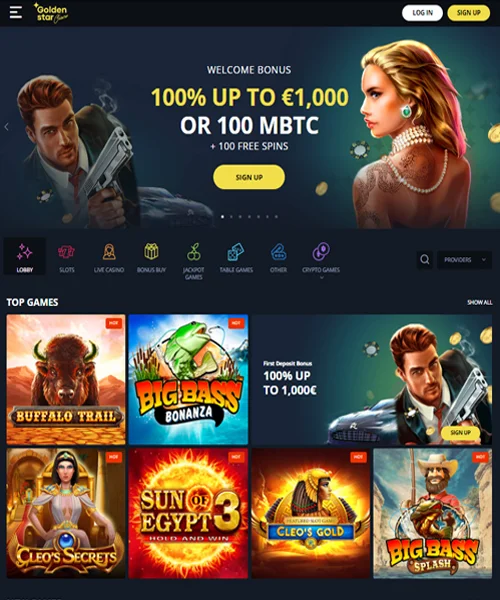

Intense battle appetite gambling enterprise application provides to utilize the creativity to have carrying out you to-of-a-kind video game. Free gambling establishment harbors try laden with all types of bonuses you to total up to full pleasure of your game and boost your winning odds. Let’s identify the most popular incentives you might see inside the a position. You happen to be capable go to their website and then click a video game visualize and begin playing. But not, chances are you will have to perform an account on the casino. Then after logged inside, you’ll be able to gain access to the fresh gambling establishment reception play the games from that point.

Since the an excellent respite, a keen RTP casino raging bull 25 free spins away from 96.5% is always to favor the possibility of a maximum win. How to enjoy online harbors is by checking out an internet gambling establishment which provides demonstration types away from slots. When you’ve chosen the newest slot you need to gamble, mouse click “demo” or perhaps the advice hook up (usually a lowercase “i”) then prefer demo setting. Online casino position game are extremely simple and readable when to play. You wear’t need to be an experienced athlete to evaluate the brand new slot online game.

Addititionally there is a great jackpot wheel having around 5000x wager open to getting won. I also offer all of the players a choice to the number of 100 percent free revolves and arbitrary wilds after they enter into the advantage bullet. The players would love the video game with up to forty five free spins available. I am Niklas Wirtanen, I work with the web betting community, and i am an expert casino poker athlete. I’m hoping my possibilities can assist build your playing sense best. Free slots which do not require you to put your currency to help you a gambling establishment webpages to enjoy, otherwise slot games used in no deposit incentives.

Type of Slots

All of these ports has extra spins, 100 percent free video game, wilds, scatters and more to store the experience upcoming. If you want, you could potentially wade directly into our complete online game posts because of the video game type of such as our very own step 3-reel slots, three-dimensional Harbors otherwise free video ports. A good “double otherwise quit” game, which gives participants the opportunity to twice the payouts. There are many slots have that you should be more aware of when looking for your next greatest on the web position. Such provides is nuts signs, spread out symbols, and you can multipliers.

Numerous 100 percent free revolves enhance which, racking up nice winnings away from respins rather than burning up a money. Most of the time, winnings from totally free revolves believe wagering criteria before withdrawal. Slots to experience for real currency wanted a real income deposit and you may subscription, letting you earn real money otherwise jackpots. The fresh betting machines provide exclusive game availableness and no join partnership without email address required. The availableness is entirely anonymous as there’s zero membership necessary; have some fun.

The brand new 100 percent free harbors 2025 provide the most recent demos releases, the new casino games and 100 percent free slots 2025 which have 100 percent free revolves. 100 percent free ports no down load games obtainable anytime that have an internet connection, zero Email address, no registration details wanted to acquire accessibility. Once signed in the, rating a quick enjoy from the pressing the brand new free twist button to start a game lesson. Usually, the objective of this type of rounds would be to provide more implies to possess people to win. Obviously, at the same time, app organization also offer a better betting sense. Almost all bonus rounds for sale in totally free harbors can also be found in their models that need using real money.

- And you can thrill, or even labeled themes that will be considering popular movies otherwise shows.

- Goldfish gaming host has only incentives to possess landing 3 Fish Eating signs, Gold or red seafood.

- Because of the concentrating on thrill and you will entertainment, we now have ensured VSO is the just site you will have to come across the proper game for each minute.

That’s slightly a remarkable tally, especially in annually you to definitely hasn’t even passed. A plus round and that benefits you a lot more spins, without having to set any additional wagers on your own. According to for example gamblers, in the event the a certain method assisted anyone else, it will improve their successful possibility also. Let’s seek out aside why winning actions are nevertheless therefore glamorous to own gamblers. On this page, i talk about roulette variations and you will wise a way to increase opportunities to flourish in roulette. Congratulations, you are going to today become stored in the new know about the fresh gambling enterprises.

Is Bonus Have within the Online Slot Video game

In addition to look through a variety of most other totally free harbors zero registration or down load necessary. Today, professionals can choose from a large number of free gambling enterprise ports online game out of other software makers. The brand new games provides additional plots, legislation, connects, incentive possibilities, and you may jackpot possibilities. Making use of their excellent designs, particular free harbors video game will be known as masterpieces from pop music society. The brand new fun game play are combined with beautiful visual consequences (2D and 3d image, animation) and you can realistic songs. As well as, totally free slot machines disagree by number of reels.

Discover Me Element

Concurrently, the game have an enjoyable soundtrack one adds to the mood and you will adventure within the video game. Sounds of rotating reels, payouts and you will bonus cycles then focus on the newest sweet theme of the games and make the fresh game play far more interesting. Take note that there are numerous internet sites which can request your financial guidance before you take pleasure in a chance otherwise two. We strongly recommend that you avoid those web sites since they’re purposely made to scam your.