Articles

Minimal withdrawable amount are £10, as the limitation count may differ on the payment choices. The newest commission choices are restricted, but the punctual processing of your own transactions over makes up to the omission out of far more commission choices. Distributions are processed as a result of Visa Debit cards, PayPal, Paysafecard account, and bank transmits.

Mongol treasures slot machine: Yggdrasil Playing Slot machine Reviews (Zero 100 percent free Games)

Welcome to CasinoMentor, their go-in order to destination for great gambling establishment bonuses, lingering campaigns, and you can pro recommendations. On this page, i curate the newest greeting now offers featuring a remarkable 150 Free Revolves No-deposit necessary. Just prefer your chosen gambling establishment, perform a different account, and start playing!

More Games

Insane we have found a football star image, and it alternatives with other symbols doing a “successful” integration. Throughout the the research, i thought the newest people’ hobbies by the considering program and cellular compatibility. In that way, you can enjoy your experience and you will control your issues on the wade.

Most other Online game

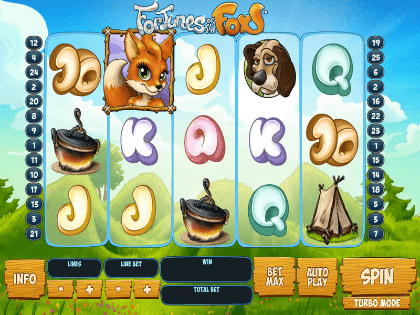

This is how to find and have this great incentive and no deposit required mongol treasures slot machine . With so many people reliant on the phones to possess relaxed work, we know how important it’s you could enjoy particularly this extra on the one another your computer and your mobile device. We make sure the casinos offering that it added bonus is actually cellular-appropriate to accessibility the new gambling webpages using your mobile web browser or a mobile application. Which Microgaming slot to own phones and you can pill might not get to the levels ones a couple of antique video game, nonetheless it continues to have so much to offer the careful casino player.

- Now that you discover exactly about 150 totally free spins incentive also offers, you could potentially allege the no-deposit revolves.

- It is really worth noting you to both activity websites are made the new exact same year.

- This can lead to broadening wilds and a good multiplier path one develops with each move.

- All victories spend of kept in order to right with the exception of Scatter and that pays any several gaining combos given for each and every shell out.

- No-deposit join bonus for brand new British professionals away from twenty five 100 percent free spins on the common position Publication from Inactive.

Released in may 2020, the new Activities Superstar Luxury slot machine includes that which we enjoyed in the the initial position, plus much more. Symbols is common but, they’lso are to your a different reel place, that have big earnings. Fundamentally everything is slicker and you will a trendy sound recording and roaring voice-more energizes the gameplay. Noah ‘s the senior content publisher from the CasinoCrawlers and you may an author with many different iGaming posts less than their collection. For this reason, he is competent at the creating incentive assistance, playing actions, and you will casino recommendations. While in the their spare time, the guy has to try out Name out of Duty which is a huge rugby partner.

Karolis features authored and you will edited those position and you will gambling enterprise reviews and has played and you can checked out thousands of online slot video game. Therefore if there is certainly another position term being released in the future, you best know it – Karolis has recently tried it. The new striking crazy feature may appear each time inside ft video game.

Responsible Playing and User Shelter

With 150 100 percent free revolves no deposit needed, you could potentially diving straight into better slots and start successful actual money. Whether you’re a seasoned athlete or not used to the video game, such free spins give you the perfect opportunity to talk about exciting online game and you can improve your bankroll without the exposure. Because the action begins, the brand new victories remain coming, on the about three added bonus game bringing cardio phase.

The fresh elizabeth-wagering system was created to be associate-amicable and you will intuitive, having various gambling options to suit some other choice and you will budgets. If or not users try seasoned elizabeth-activities bettors otherwise fresh to the realm of on line gambling, SpinBetter will bring everything you needed for a thrilling and you may fulfilling gambling feel. The players’ protection and advanced away from solution would be the concern out of SpinBetter online casino.

It is rational to look at Gambling enterprise Z an alternative site having a fresh style. The brand new playing business is belonging to Orakum N.V. Besides this gambling on line enterprise, Local casino Z founder is within fingers from Megapari Gambling enterprise. It’s worth detailing you to both enjoyment other sites are designed the brand new same year. You could potentially have fun with the Sporting events Glory slot machine game having fun with Bitcoin in the people gambling establishment taking which while the a deposit choice.

From welcome incentives in order to a big number of online game to try out, Ignition Casino try the leading site to have internet casino gaming. Yes, a real income ports is simply legitimate when choosing a professional and you will top gambling enterprise to experience. Here is the key to with a pleasant on line to try out end up being. The pros simply recommend a real income internet casino choices and if they allow it to be their Aussie participants to make a deposit playing with AUD currency. 5 reels, step 3 rows and you can 243 outlines, Sports Superstar position is just one of the easiest gaming in order to play with. When to try out Sporting events Superstar on the web or from the a online local casino, the game is the identical.

Once you have joined your account, you happen to be needed to over yours suggestions as well as the establish 2FA and you will hook up your own cell phone. This type of more levels of security enhance the legitimacy for the on the web crypto gambling establishment. Spinbetter Sportsbook are a paragraph enabling setting bets for the certain football events, in addition to however simply for football, basketball, baseball, horse racing, and much more. The fresh sportsbook is situated in a specified city which can be managed by educated professionals who make sure that all bets are placed accurately and you will rather.

Striking Crazy function may appear randomly any time plus it have a tendency to change reels 2, three to four on the Nuts having a guaranteed winnings. Cellular gamers come in line to own a smooth playing feel for the the new circulate, that have one thing taking extremely fascinating when effective symbols initiate bursting to the the brand new display screen. Loaded Wilds, Moving Reels, Striking Insane ability and Free Spins bullet are in place to improve your own line wins. Having nice acceptance bonuses, quick withdrawals, and you will a comprehensive choice of video game, it’s easy to understand as to the reasons Position Globe is a favorite among participants.

Enjoy Sports Superstar Luxury free of charge right here, today and have a piece of your step. You could find out more better harbors out of Microgaming regarding the listing lower than. When you are 150 no deposit 100 percent free spins try popular with of several players while the no-deposit is required, there are many different other 150 totally free spins incentive offers.