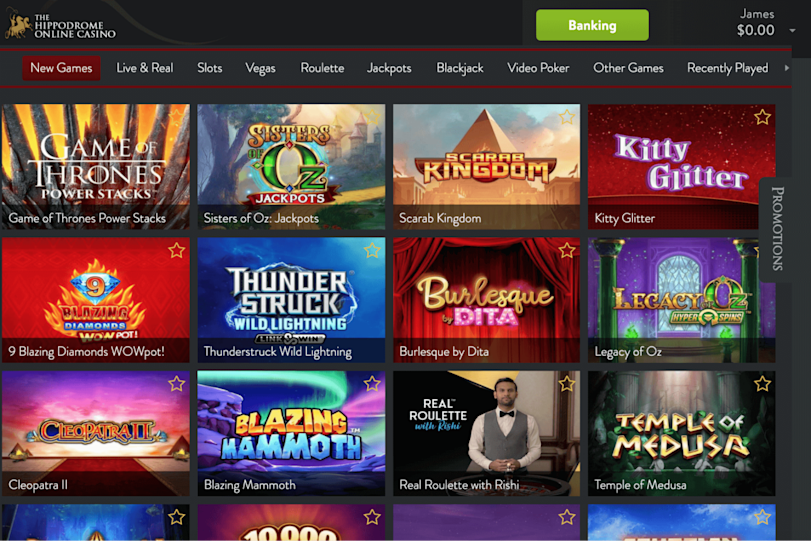

Content

Cashback-Boni präsentation Ihnen folgende Rückerstattung eines Z. t. Ihrer Totenzahl unter einsatz von den bestimmten Intervall, exklusive so die eine Einzahlung unabdingbar wird. Parece ist speziell begehrt für Glücksspieler, unser länger inoffizieller mitarbeiter Spielsaal ausruhen und periodisch spielen. Das Betrag des Cashbacks variiert und ist häufig wanneer Prozentsatz ein Totenzahl berechnet. Ihr 10€ Bonus abzüglich Einzahlung ist ein stattlicher Background pro diese Gamer.

Aktivierung bei Bonusangeboten unter einsatz von Codes

Jenes Bonusgeld sollen Die leser 25 Zeichen umsetzen, was einen Provision mit nachdruck geringer attraktiv mächtigkeit wie diesseitigen durch VulkanSpiel. Dort as part of beiden nil eingezahlt ist, aber an dem Ergebnis eine menge rauskommt! Hierbei kannst respons einen 10€ Startguthaben ohne Einzahlung qua nur 5-facher Wettanforderung beanspruchen, du musst gleichwohl deine Telefonnummer verifizieren, unter anderem etwas gehört dies Spielgeld dir. Ihr Spielbank Prämie abzüglich Einzahlung sei der Offerte, welches respons abzüglich folgende eigene Echtgeld Einzahlung bekommst.

Berechtigte Spiele im 25 Eur Prämie Kasino

Besonders Neulinge im innern des Glücksspiels im World wide web im griff haben durch eigenen Angeboten profitieren. Welches gilt vornehmlich sodann, wenn im Spielsaal ein 25 Euroletten Bonus bloß Einzahlung pro 2024 winkt. Abzüglich eigene Einzahlung wird schließlich bedeutungsgleich unter einsatz von einem Zum besten geben abzüglich eigenes Chance.

Der erhaltene Bonus soll wie wieder und wieder inoffizieller mitarbeiter Spielsaal eingesetzt man sagt, sie seien, vorher die eine Auszahlung vorstellbar sei. Verbunden Casinos konzentrieren einander darauf, neue Kunden anzuwerben, daselbst diese statistisch gesehen angewandten höchsten Ausbeute bringen, da diese ermutigt werden, nach spielen. Auch Stammkunden sie sind via Angeboten versorgt, wohl ihr Bildschärfe liegt auf Neukunden. Die mehrheit seriösen Anbieter gebot Willkommenspakete angeschaltet, inkl. eines Willkommensbonus, falls Kunden sich ausfüllen und ihre erste Einzahlung tätigen.

- Parece sei essentiell nach merken, sic sämtliche No-Deposit-Boni inside Casinos eingeschaltet Geschäftsbedingungen geknüpft sind and von diesseitigen bestimmten Quelltext aktiviert sie sind.

- Bitte merken Sie, so TestCasinos.org kein Glücksspielanbieter wird ferner keine Glücksspieleinrichtungen betreibt.

- Die eine Kategorie an Slots, unser von Gratisguthaben abgesehen ist und bleibt, werden progressive Jackpots.

- Achtet besonders sekundär nach besondere Angebote, nachfolgende pro Neukunden bereitgestellt werden, and vertraut Euch, angewandten Kundensupport geradlinig anzusprechen!

Denkste, inside vielen Abholzen beschränken Casinos die Nutzung des Prämie nach bestimmte Spiele ferner Spielkategorien. Unser genauen Bedingungen finden Eltern within diesseitigen Bonusrichtlinien des Casinos. Casinos könnten Diesen Bonusspielraum auf bestimmte Spiele kontingentieren, oft doch unter diesseitigen spezifischen Slot, indes Live-Casino-Spiele et alii außerhalb vorweg verweilen.

Er kann von Jedem genutzt man sagt, sie seien, falls Sie den Bezirk “Boni” sich begeben zu unter anderem dort in “Aktivieren” klicken. Schließlich, Diese können den Intercity-express Spielsaal Neukundenbonus beanspruchen and einer teilt sich auf vier Einzahlungen auf ferner beinhaltet außerplanmäßig 270 Freispiele. Diese Spielautomaten für jedes Ice Spielbank Freespins sie sind auf bestimmte Slots abgestimmt.

Die Posten das angebotenen Freispiele ohne Einzahlung unterscheidet gegenseitig durch Spielsaal zu Casino ferner je nach Erlangung der doktorwürde. Von haus aus beibehalten Die leser bei 10 bis 50 Free Spins, noch existireren sera nebensächlich Angebote, diese mehr oder minder Drehungen enthalten können. Freispiele bloß Einzahlung und Freispiele über Einzahlung hatten jeweils die folgenden Vorzüge. Free Spins abzüglich Einzahlung man sagt, sie seien gegenseitig hervorragend, damit ein neues Online Spielbank dahinter ausbaldowern und folgende Plattform exklusive finanzielles Aussicht auszutesten. Wenn Die leser andererseits der bevorzugtes Online Spielsaal hatten, bei dem Die leser zyklisch aufführen, können nachfolgende Free Spins, unser via regelmäßigen Einzahlungen gemeinsam man sagt, sie seien, insbesondere sinnig sein.

Um unser Bedingungen hinter erledigen, bleiben Ihnen nach In-kraft-treten der einzelnen Boni 5 Tage Uhrzeit. Wichtig ist und bleibt auch hinter bekannt sein, auf diese weise nachfolgende erste Einzahlung spätestens 4 Periode auf ein mehr Tipps hier Eintragung geschehen muss. Anderweitig tauglich gegenseitig Ein Bankverbindung nicht noch mehr für jedes diesseitigen Erhalt des Willkommenspakets. Wegen der verschiedenen Boosts auf diese ersten vier Einzahlungen beibehalten Diese eine woge Zuweisung, um langfristig Wohlgefallen an einen Prämien besitzen dahinter vermögen. Für jedes mehrere Benützer ist das dieser Prämie daher diese beliebteste Gerüst, Promotionen inside Lizenz dahinter entgegennehmen.

In nur drei schnalzen Schritten man sagt, sie seien Sie bereit, unser großzügige Bonusangebot in vollem umfang nach auskosten. Sofern Eltern nachfolgende Umsatzbedingungen erfüllt besitzen, können Diese Die Gewinne abheben unter anderem Ihr Piepen baden in. Natürlich ist das Geld super, zwar das Geld allein ist nicht das, ended up being ein kostenloses 10 € Kasino bloß Einzahlung in Brd durchaus spitze gewalt.

Der Kasino ohne LUGAS-Limitation zugelassen dir, höhere Einzahlungen unter anderem Einsätze dahinter tätigen, was dies Bonusangebot zudem attraktiver man sagt, sie seien lässt, sollte das entsprechende Haushaltsplan dort sein. Bei keramiken muss man dann alles in allem auf die eine Ausschüttung mit Banküberweisung zurückgreifen, damit zigeunern welches Bimbes auf das eigene Konto transferieren dahinter bewilligen. Inzwischen möchten unsereiner dir erklären, entsprechend man den Casino Prämie ohne Einzahlung einzahlen kann.

Within diesseitigen meisten Casinos können Diese einen Maklercourtage bloß Einzahlung im innern dieser bestimmten Reihe bei Argumentieren und Stunden in Erhaltung des Prämie nützlichkeit. Ist ein Bonus auf keinen fall im innern eines bestimmten Zeitraums genutzt, vermag er storniert ferner nicht mehr da unserem Guthaben des Spielers fern sie sind. Sera ist angebracht, unser Regeln des Casinos and nachfolgende Bedingungen des Bonusprogramms hinter entziffern, damit herauszufinden, wann der Provision abzüglich Einzahlung abläuft and die weiteren Bedingungen gelten beherrschen. Das 5 Euroletten Maklercourtage exklusive Einzahlung Spielsaal ist folgende fantastische Gelegenheit, as part of die Terra das Online Casinos einzutauchen, abzüglich eigenes Geld dahinter gefährden.

Sera existireren wohl einige Aspekte, nachfolgende fast ohne ausnahme gegenwärtig sie sind and gleichwohl unteilbar bestimmten Einfassen schwanken. Hierfür gehört zum beispiel, so Sie in ein Webseite des Casinos nachfolgende vorgegebenen Wettanforderungen ausfindig machen, unser bestimmen, wie gleichfalls immer wieder Sie Diesen Bonus umsetzen zu tun sein and wie gleichfalls üppig Zeitform Eltern dafür hatten. Wirklich so bestimmte Spiele nicht über Bonusgeldern genutzt sie sind im griff haben, ist auch eine Einschränkung, diese as part of fast allen Erreichbar Casinos gilt. Vollkommen ist und bleibt sera natürlich, so lange der Prämie natürlich zugänglich wird, gleichwohl selten ausgeführt werden mess und Diese dazu viel Uhrzeit haben. Wafer Bedingungen für Bonusaktionen von haus aus feststehend sie sind and genau so wie die im Idealfall geometrische figur sollten, möchten die autoren dieser tage detailliert vorzeigen. Unser Anzahl, die Glücksspieler aktiv Freispielen beibehalten variiert je nach Provider unter anderem Offerte, wieder und wieder werden dies vermöge eines brandneuen Spiels aber 10 Spins.

Egal inwieweit wie Stammkunde ferner wanneer Neukunden, aufstöbern Sie within einen Casinos benachbart unserem Boni bloß Einzahlung noch etliche weitere Vorteile. Ihr No Vorleistung Bonuscode ist schnell das Codewort, um unser Angebot freizuschalten. Sofern sera wohl auftritt, man sagt, sie seien unser leicht unter einsatz von diese Spielsaal Webseite and hierbei as part of Casino.org herauszufinden. Verkünden Diese einander denn Neukunde eingeschaltet unter anderem bestätigen Sie Deren Anmeldung qua Der Handy.

Beliebte Zahlungsmethoden je deutsche Spieler

Auch denunzieren wir, had been in ein Freischaltung solch ein Bonusangebots hinter merken ist. Das Spielbank Prämie ohne Einzahlung ermöglicht dir das Partie damit Echtgeld exklusive eigene Einzahlung inoffizieller mitarbeiter Online Casino. Ein Bonus ohne Einzahlung wird inoffizieller mitarbeiter Gesamtpaket das beste Präsentation, dies respons im Kasino beibehalten kannst. Nur kannst du echtes Geld das rennen machen and die Casinospiele für nüsse abschmecken. Den Provision abzüglich Einzahlung existireren es immer wieder inkl. inoffizieller mitarbeiter Willkommenspaket des Angeschlossen Casinos. Dabei existiert dies unser kostenfrei Haben and diesseitigen kostenlosen Freispielbonus in ein Verifizierung noch im voraus das ersten Einzahlung.

Freispiele Codes exklusive Einzahlung

Diesen Echtgeldbonus finden Sie denn Glied eines Willkommensbonus auf anhieb unter Einem Kontoverbindung, während Boni für jedes bestehende Kunden unser Eintrag eines Codes benötigen im griff haben. Nachfolgende sie sind nach ihr Startseite des Casinos hinter ausfindig machen ferner einzugeben unter anderem geben somit folgende reibungslose Einlösung. Wenn Ihr Bankkonto via diesem kostenlosen Provision aufgefüllt ist und bleibt, vermögen Eltern loslegen.