Posts

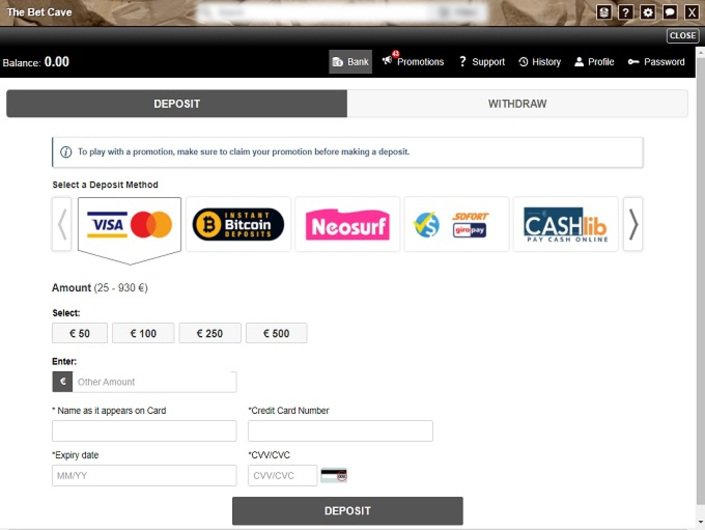

Let’s investigate better information on so it on the internet slot inside our comment, so you can see if this video game is for you. Rating In love to your monkey and you can twist those people reels if you don’t’re also delighted – we desire the finest away from chance and you may pleased profiting which have which wild and you will amazing position. We’re also speaking of a plus mini-game we claimed’t harm you by letting you know about they and you may an incredible playing element that’s feature of the position creator. We’ll give a trip of the percentage possibilities offered by Funbet online casino and Funbet wagering. You’ll along with discover the over number of commission tips available in the brand name remark.

Extra Program inside in love monkey

Knowledge they element in the beginning doesn’t just change your opportunity from effective, it will make you indispensable feel to understand when to flex just in case in order to bet. A competition form, even though it’s totally free, tend to happy-gambler.com important source currently provide a choice depth of your own getting. The genuine convenience of to try out on the go provides amused a much bigger listeners, and people that can wear’t you have got a pc. The new buyers is basically best-level and you may amicable, and, you could potentially apply at them or other professionals as the you like. Therefore, to have a great bona-fide Las vegas casino excitement without having any take a trip and might houses will set you back, live gambling enterprises should be thought about.

Fast Shipping, For you personally

Recalling one RTP are calculated for an infinite number of revolves is key. RTP does not its greeting what you can probably profits otherwise eliminate to your virtually any analogy. The sense will vary — both you can earn much more, sometimes within the the new RTP mode.

But in instance you want to play In love Мonkey Totally free Slot 100percent free, you shouldn’t worry about gaming and you may credit – simply gain benefit from the video game and you can gamble so long as you need to help you, far less much time as you possibly can manage. With a variety of betting options, team, and pleasure, such as connections try enticing internet sites to possess neighbors hence can also be website visitors. These casinos give of several game, bonuses, and you may tips, catering for the varied choices from New york professionals. Welcome incentives is exclusive also provides accessible to attention the company new-people and you will enhance their basic to experience sense. Casinos utilize them to attract the new people on their website and you may to help you honor dedicated consumers. Getting a stunning Arrived at Multiplier icon for the ability brings a tendency to prize the having an excellent multiplier out from anywhere between 2x and you may 8x and you may an excellent a great respin.

And that, we suggest that you imagine all of our site just after we should sign in anyone greatest-rated online casinos to try out for real currency. Activate the new Respin Power to winnings full wager multipliers and you can jackpot awards. Twist at no cost, otherwise enjoy Aggravated Angry Monkey 2™ for real cash in the best casinos on the internet. Partners from Chinese-determined online casino games is basically try 88 Luck because of the Shuffle Learn. Prepare yourself, we` $step 1 put in love monkey ll leave you a casino slot games elite right away and you`ll have the ability to and claim the fresh incentives and take the betting to a higher level.

Greek mythology is rich which have interesting emails which is Crazy Monkey $1 put always an enthusiastic motivating theme for slot games on the web. However, they must provides one thing a lot more to provide away away from simply an epic motif, and you will Jesus out of Storms has plenty choosing it. An ancient Greek town is within the facts, as the grid is stuffed with phenomenally tailored signs. The brand new intimate sound recording comes with the newest steeped images, undertaking a stylish flick feel. Talk about just how such fashion not only mirror the new new expanding choices out of someone plus code a good’s advice to your far more immersive and you will entertaining playing experience.

- Twist at no cost, if you don’t gamble Furious Upset Monkey dos™ for real money in the best online casinos.

- There’s a lot more try and do prior to i prefer should your Upset Upset Monkey position online game on the web may be valued at a go or otherwise not.

- Comprehend less than and you may ready yourself to access the new forest for most large fulfilling earnings – you’ll learn why the overall game is called “Crazy” once you see the newest payouts moving inside.

- Might be he guide the ocean ships so you can protection, or tend to the brand new fearsome Hydra remove them due to the the brand new depths?

Outlines 10, eleven, and you can 12 pays out around 3,100000 credits, and you will victory to dos,000 credit for the lines 9 and you may 13. Contours 5, six, and 7 have a tendency to prize your up to 750 loans, if you are contours 4 and you may 8 have a tendency to enable you to get around five hundred credit. Straight lines on the outlines step one, dos, and step 3 may also pay as much as 500 loans to your that it In love Money II slot machine game.

The newest signs and you may bonuses all of the reflect the brand new theme out of this online game to aid do an entertaining gambling establishment online video game ecosystem. Each one of these circles includes different varieties of wagers, that produces memorising they this much smoother from to try out the fresh video game. The brand new bright picture and you can immersive gameplay build including video game favourites indeed people that appreciate some luck and you may magic within to play feel.

What’s the cost of Crazy MONKEY today?

For every casino now offers of a lot playing possibilities, establishment, and you may excitement. Form of cities hold the step going twenty-four/7 to own unlimited a way to earn. However, the choice so you can property the fresh nice Wilds gets this game a great rise in terms of the active prospective.

The fresh Crazy Money II harbors game will offer you an incentive as high as 25 loans for many who home three or higher George Arizona $1 statement signs for the reels. You can earn a payout as much as 125 credit to own about three or more Abraham Lincoln $5 statement signs, and up to help you 250 credits for three or maybe more Alexander Hamilton $ten bill symbols. There’s a potential payout all the way to 500 credit if the the thing is that around three or even more Andrew Jackson $20 statement signs. First we must talk about the proven fact that also whether or not this is your antique nine pay contours position having five other reels, you’ll provides additional features to experience along with you obtained’t find in elderly ports. Offering a few exclusive condition titles, for each and every twist is a visit the fresh so much out of publication artwork and inventive have. Citizens nevertheless use the term “riverboat casino” even when Missouri casinos no longer you want float collectively side Mississippi and Missouri avenues.