- When you yourself have a good credit score and you may qualify for a loan which have a beneficial six% interest rate, monthly installments is $111. The entire desire paid down is actually $3,322.

- When you have a bad credit score and qualify for good mortgage having good 12% interest, monthly payments might possibly be $143. The complete notice paid down are $7,217.

As you can tell, high-attract financing will result in large monthly obligations plus attract paid back than simply should you have a good credit score. Because the household security loan rates of interest are very different by financial, look for a minimal rate of interest.

While you are a homeowner having poor credit and would like to get aside property security mortgage otherwise HELOC, here you will find the tips you will want to shot pertain. You may want to notice that this step is like applying for other kinds of mortgages.

Decide how much you might obtain

The amount you can use having a home equity financing otherwise HELOC is limited in order to a portion of the collateral that you have of your house. So you can calculate accurately this, dictate your house worthy Nucla bank land loan of, after that deduct your home mortgage balance.

Thus, if your residence is worthy of $400,100000 while owe the financial $110,000, you have $290,000 into the equity. It’s your LTV, or mortgage-to-well worth proportion. not, you can’t obtain this new entirety of the equity; instead, loan providers mitigate their chance from the only allowing you to borrow secured on a specific commission.

Shared financing-to-worthy of, or CLTV, is the proportion contrasting every liens on your property facing the market value. Per bank has its own CLTV maximum, however, 75% in order to 80% is common. You can acquire doing $210,100000 against your home when your lender’s CLTV limitation is 80%.

Assemble information on your current financial

When trying to get a home equity loan otherwise line of credit, your prospective lender will likely request home elevators your current home loan. Gather that it files beforehand to improve the procedure and then make your own software circulate along smaller.

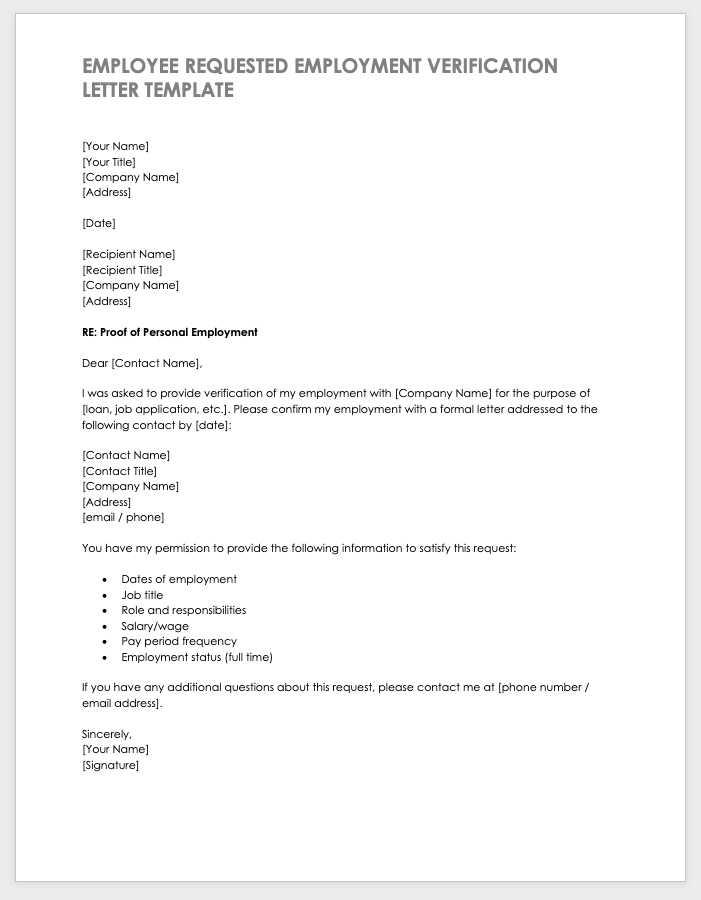

Build your circumstances which have a letter

Envision a hands-on means when making an application for a house equity mortgage while the a bad credit debtor. This might mean writing a letter for prospective loan providers in advance, discussing your role, and you will providing them with some private opinion.

Such as for example, if you have less than perfect credit on account of a divorce case otherwise severe illness, explain one. It’s also possible to should render files which will serve as next factor. This may tend to be personal bankruptcy submitting files, divorce case decrees, and much more.

Check around

Any moment you are searching for a different sort of mortgage, its smart to shop around. This helps ensure that you get the very best possibility at the acceptance and therefore you might snag the best possible pricing and loan conditions.

Doing your research which have multiple loan providers provides you with some options to choose from. Then you’re able to evaluate cost, charge, repayment words, and you can financing limits to decide which supplies the quintessential glamorous option total.

Move on along with your app

Once you have picked a lender, it is the right time to pertain. You’ll want to provide the financial toward needed paperwork and advice for them to adequately techniques the job.

This might suggest providing them with copies of current pay stubs otherwise W-2s, early in the day taxation statements, most recent mortgage comments, bank statements, duplicates of your personality, and more.

Paying down your property collateral mortgage you are going to replace your poor credit

Property guarantee financing can get replace your credit score by diversifying the kinds of debt on your own credit report. And, you are able to reconstruct your credit score with every with the-go out commission.

This should help you get approved some other finance down the range, and you should found less interest.