Posts

Subscribe now during the Brango Gambling establishment to grab the big added bonus and discover whether it matches your look. Surprisingly, their real time gaming equipment didn’t cut off up until 2018. One seasons, the firm closed a binding agreement for the Portomaso casino chain, allowing them to load online casino games straight from one of these greatest property-based gambling enterprises to on the internet professionals.

Betsoft video slots games: Mybet support

- Instead, you’ll receive pop-upwards announcements when you’re signed in the, getting the best reload incentives to possess 2025.

- Position online game compensate most of the online casino extra offered by MyBet Gambling enterprise.

- Going through certain customers ratings online, MyBet Gambling establishment has arrived a score away from 6.5 from your front side since this platform stops a huge customer desire of countries such as India.

- The opportunity to withdraw the profits, the client need ensure the newest account.

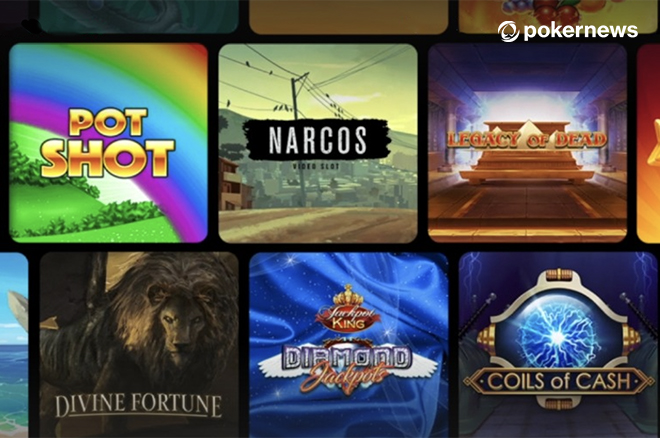

Noted for the visually excellent and you may innovative position online game, NetEnt will continue to force the new boundaries away from on the web gaming. Their slots are celebrated to own high RTP rates and groundbreaking have. Pragmatic betsoft video slots games Enjoy ‘s the community’s leading merchant away from iGaming points. Their real time games choices function high-quality displays and you will 4K online streaming. These enhancements make Pragmatic Play’s alive betting equipment far more attractive to own people in the 2022, and you can, however, within the 2024. Don’t proper care, this article will give you a call at-breadth report on the brand new MyBet Gambling enterprise.

Deposit £ten Minimal to possess Access to Fascinating Incentives

The fresh documents try kept in the company’s database but far more bits of data files would be questioned because of the the second to examine the newest membership. There’s in addition to a solution to try the newest video game just before investing in your own actual money. This site looks slightly receptive since the games have a tendency to weight rapidly. Gambling establishment 100 percent free Revolves are also an enjoyable extra, though there is nothing novel regarding it offer. Hence, if you are searching for an internet site that have very good opportunity to possess gaming to your activities over, you should definitely consent to Mybet.

Introduction to help you Mybet Gambling enterprise

Also offers highest-top quality real time online casino games, centering on immersive Roulette and you will Black-jack enjoy having top-notch buyers and superior streaming technology. Such video game break the standard casino game mold, giving interactive and you can immersive playing feel having live machines. Of controls revolves to board games, these reveals render book activity as well as the opportunity to earn big. Real time broker online game submit a sensation such few other standard on the internet game also provide.

- Ahead of entering playing, ensure conformity with regulating criteria.

- Possess excitement out of a live casino from the comfort of your house which have MYBET88 Malaysia.

- ALLBET is actually an excellent B2B organization concerned about Far eastern fans, giving away 100 percent free credit offers sometimes.

- Behavior to the of many online casino games with the local casino 100 percent free enjoy otherwise practice mode.

- By using arbitrary matter turbines, we be sure a completely unbiased playing experience.

Once caused, a fortunate spin provides the entire container in one payout. Daily far more online game are available in Mybet Gambling establishment, presently there are about 2000 ones. Make use of the on-line casino and don’t forget about a lot of advertisements, special deals, etc. For each goods is available in a trial type, it’s totally free, so you can visit us even although you should not test for real currency.

Each and every pro you to definitely keeps a merchant account might possibly be protected while the webpages is actually subscribed by the Malta Playing Power and you may abides by playing laws and regulations. The new fairness away from online game is hoping because of routine audits that are performed and this make certain payout proportions and you will tests the event of one’s RNG to your all the games. While in the our very own in the-depth overview of Mybet Casino, we were surprised by multitude of position headings you could potentially appreciate on the one another pc and you can cell phones.

Brango Casino Faq’s

Along with, a number of the small print of your program may not end up being of good let in case your pro chooses to create specific advantages of MyBet Gambling establishment. •Specific gambling models or steps are forbidden whenever playing with bonus money. •The new MyBet Gambling enterprise website has a good Comodo safer certification and you may the brand new PCI DSS secure. Along with, your website is SSL encoded permitting in the protecting the brand new research of every player who has a merchant account on the gambling establishment. •Video game company such as Gamble’letter Wade, Red-colored Rake Playing, NetEnt, and you may GAMOMAT improve the player so you can dive along the some game hence keeping the newest enjoyment cause of look at.